In its report, Capital Intelligence highlighted that the main credit strengths for Kamco Invest continue to be the substantial volume of assets under management giving a large and normally stable revenue stream, and the growing investment banking business. While the earnings contribution from non-Kuwait geographical expansion has been limited to date, it is growing and offers considerable opportunities for the future, both in terms of earnings growth and in reducing geographical concentrations. In the meantime, the real estate platform has been generating regular and growing asset management fees.

Further important credit strengths include low leverage and debt-equity ratios, particularly on a net basis, and a strong and capable management team. The value of the wider KIPCO Group is seen as being a major source of both asset management funds and IB business, rather than as principally being a source of extraordinary support. The closer ownership and cross-selling with Burgan Bank are seen as being a positive development. Burgan Bank and other KIPCO group banks could (in case of need) be a potential additional source of funding, although as a matter of policy all current bank funding comes from third-party banks. The overall level of borrowings and net debt is expected to fall further this year, in part due to the KWD5mn inflow from the favorable legal judgment announced earlier this quarter.

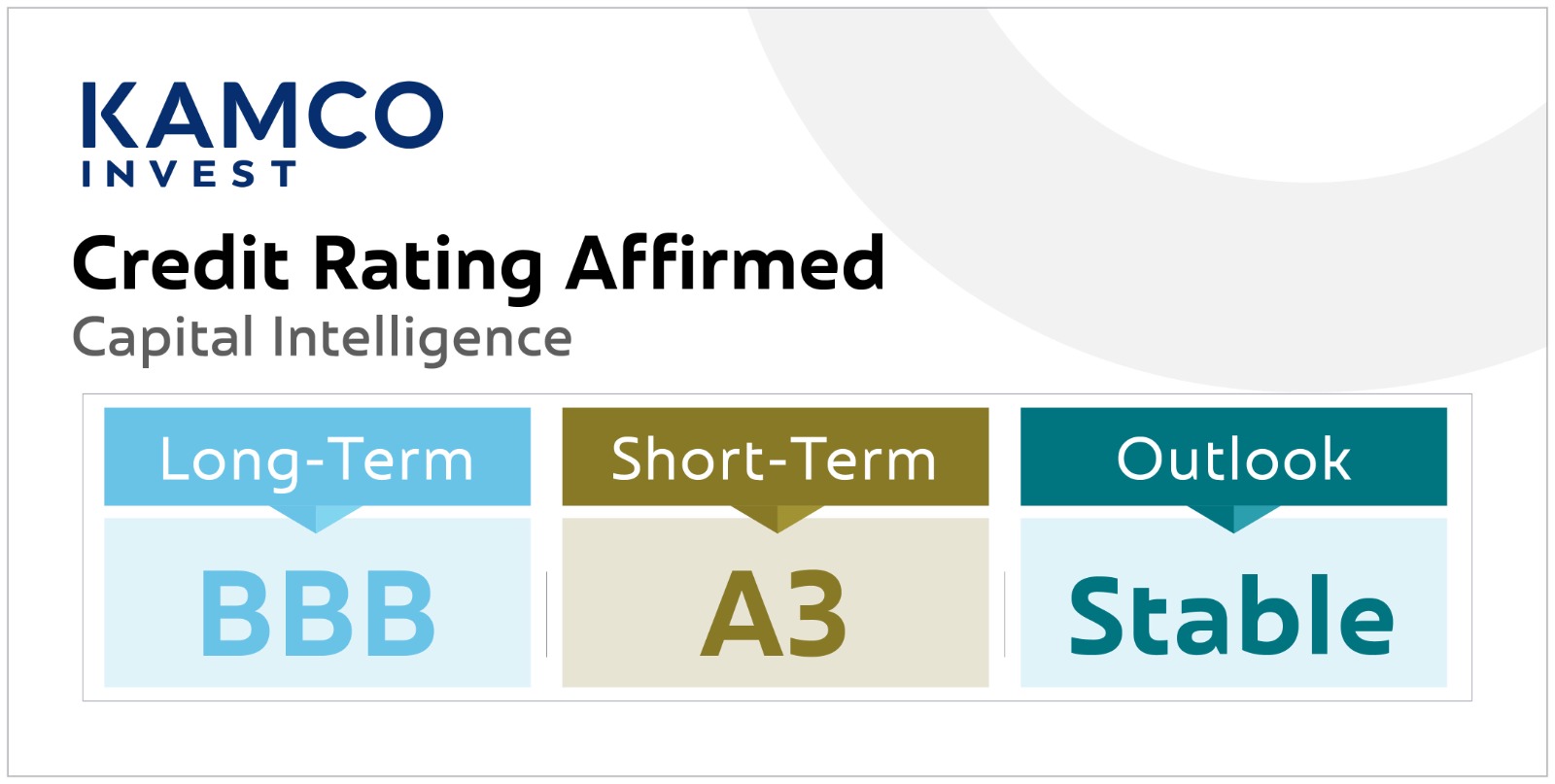

Faisal Mansour Sarkhou, Chief Executive Officer, commented, “This rating is a clear testament to the Company’s financial strength, resilient business model, and the effectiveness of our management team. We remain steadfast in our commitment to delivering on our responsibilities to stakeholders, continuously creating value, and offering innovative investment solutions that meet the evolving needs of our clients.”

Kamco Invest has assets under management of USD16.9bn, making it one of the ten largest asset managers in the MENA region according to the latest report issued by Forbes Middle East. The Company enjoys a strong financial position and healthy capital structure with KWD63.4mn in shareholders’ equity as of 31 March 2025.

Sarkhou concluded, “Our strategy remains focused on growing our fee and commission income, broadening our client base, and strengthening our presence and competitive edge across the core markets in which we operate.”