The Investment Banking teams penetrated new markets including Saudi Arabia, Oman, Jordan, and Bahrain, besides the previous activity in Kuwait, Egypt, and UAE.

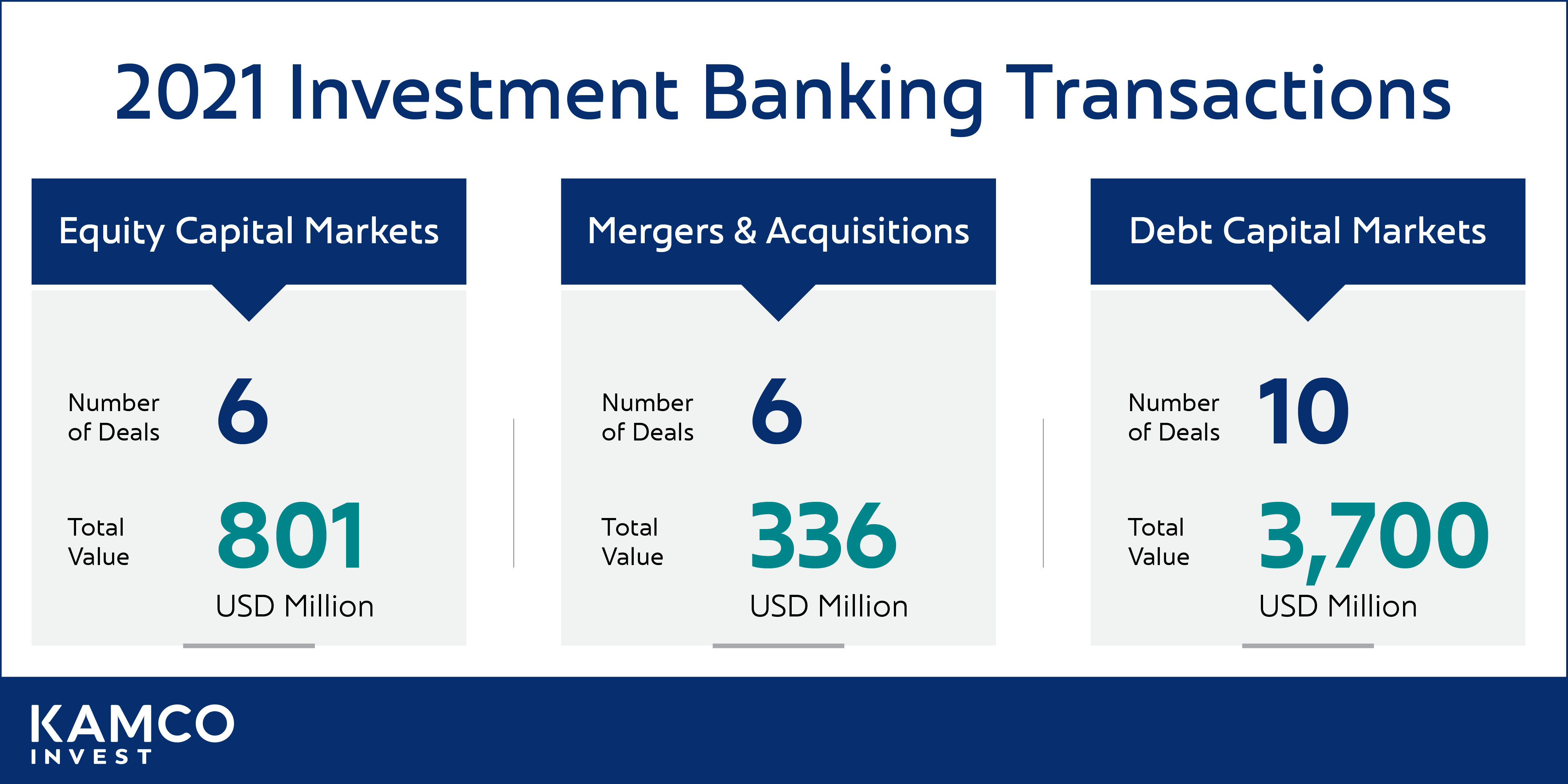

The Equity Capital Markets team concluded six transactions worth USD801mn. The transactions included the private placement and listing of a logistics company on Boursa Kuwait, the accelerated equity offering of a 26.2% equity stake in another Boursa Kuwait-listed company, and four follow-on offerings of listed companies on Boursa Kuwait Furthermore, the team launched iktatib.com, a new online subscription platform that held the first private placement in Kuwait solely relying on an online subscription platform.

The Mergers & Acquisitions team successfully concluded six landmark transactions during the year, including three sell-side and three buy-side transactions, totaling to USD336mn. The team acted as the exclusive sell-side advisor for the sale of a 60% stake in a UAE based pharmaceutical company, in addition to two sell-side mandates in the United States and Egypt. The team led the acquisition of a minority stake in a listed company on Boursa Kuwait and facilitated the acquisition of two insurance companies in Kuwait and Jordan by a local insurance group, where Kamco Invest was the exclusive buy-side advisor.

2021 was another record year for the Company’s Debt Capital Markets activities, closing ten transactions worth USD3.7bn. The team managed nine bond and sukuk issuances in Kuwait, Saudi Arabia, Oman, and Bahrain, in addition to one debt advisory transaction worth USD330mn. The issuances included six USD international debt issuances and three KWD denominated debt issuances worth USD3.4bn. A notable transaction in 2021 was the pioneering role structuring an innovative debt capital instrument for the local capital market, the first bond issuance by an insurance company and first perpetual bond issuance denominated in Kuwaiti Dinar, representing an important milestone in Kuwait’s capital market.

Abdullah M. AlSharekh, Managing Director of Markets and Investment Banking, said, “This has been an exciting year for Investment Banking on all aspects, setting a record high in terms of number and value of completed transactions. We are proud of the track record we have built over the years and for maintaining our position as one of the most active investment banks in the local and regional markets. With multi-sector expertise and technical capabilities, a strong regional footprint, and placement power, we managed to provide strategic advisory services, successfully structuring and executing key transactions that added value to both clients and the overall market.”

He added, “We expect another active year for debt issuances and equity capital transactions within the MENA region, but probably at a slower pace. This will mainly be driven by corporates seeking to finance their expansion while benefiting from low interest rates and the positive sentiment in capital markets. Additional M&A transactions are also expected in the region as the need for inorganic growth and competitive advantage increases.”

With 22 transactions completed in 2021, Kamco Invest has acted as investment banker on deals totaling USD29.2bn since inception; across equity capital markets, debt capital markets and mergers & acquisitions. Furthermore, the Company widened its regional footprint to cover new markets, strengthening its position as one of the key regional investment banks.