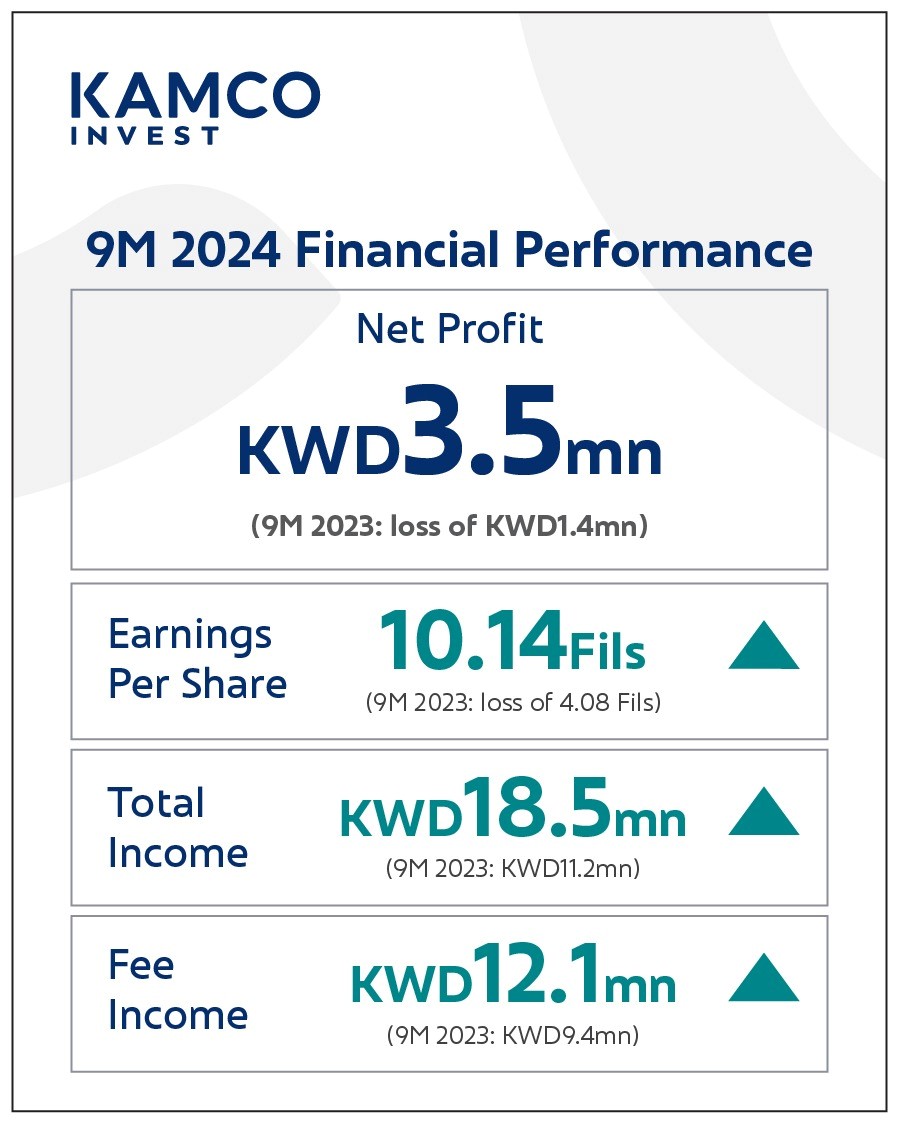

Total revenue reached KWD18.5mn, compared to KWD11.2mn for the same period last year, reflecting the positive impact of increased fee and commission income and the strong performance of the Company’s diversified investment portfolio. Fee & commission income increased by 28.0% in comparison to the same period in 2023 reaching KWD12.1mn, accounting for 65.1% of the total revenue.

As of 30 September 2024, total assets stood at KWD124.7mn, whereas shareholders’ equity stood at KWD61.3mn. The Company also enjoys a strong financial position and a “BBB” long-term credit rating and “A3” short-term rating with stable outlook by Capital Intelligence in their latest review in May 2024.

On the business side, Assets under management grew by 9.3% to reach USD16.2bn as of 30 September 2024, attributed to new money raised in various products and services during the period. Equity funds and managed portfolios continued to outperform their respective benchmarks, with local funds retaining their positions among the top performing conventional and Islamic funds in Kuwait.

Meanwhile, the Alternative Investments team remained focused on identifying and evaluating investment opportunities in real estate, private equity, and venture capital. The team also continued to capitalize on Kamco Invest’s strategic partnerships and advise clients on various transactions in key regional markets.

The Investment Banking team continued to advise their clients with several transactions in the pipeline expected to close during 2024 across Equity Capital Markets, Debt Capital Markets, and Mergers & Acquisitions (M&A). The team successfully managed 8 transactions on behalf of its clients that amounted to over USD3.1bn from the beginning of the year.

Commenting on the results, Faisal Mansour Sarkhou, Chief Executive Officer, said, “Amidst a global landscape of heightened uncertainty, market by economic challenges and global tensions, Kamco Invest’s performance reflects our strategic focus on resilience and sustainable growth. Our ability to navigate challenges and harness opportunities reflects the growth in our assets under management and the continued outperformance of our investment portfolios. This growth is a testament to the trust placed in us by our clients and the expertise of our teams.

Sarkhou added, “Looking ahead, we remain committed to leveraging our extensive market expertise and solid relationships to navigate the evolving landscape. Our strategy remains focused on identifying and capitalizing on opportunities that support our clients’ long-term objectives, while maintaining our role as a trusted partner in the regional financial markets.”