In its report, Capital Intelligence highlighted that the main credit strengths for Kamco Invest continue to be the substantial volume of assets under management giving a large and normally stable revenue stream, and the growing investment banking business. While the earnings contribution from non-Kuwait geographical expansion has been limited to date it is growing and offers considerable opportunities for the future, both in terms of earnings growth and in reducing geographical concentrations. In the meantime, the real estate assets under management is generating regular and growing fees.

Further important credit strengths include low leverage and debt-equity ratios, particularly on a net basis, and a strong and capable management team. The report highlighted the potential and value of being part of the KIPCO group for its business lines, namely asset management and investment banking. Similarly, the group banks could be a potential additional source of funding, as all current bank funding comes from third party banks. Moreover, Kamco Invest continues to enjoy considerable flexibility in its funding plans given existing substantial cash balances, plus committed but undrawn bank lines.

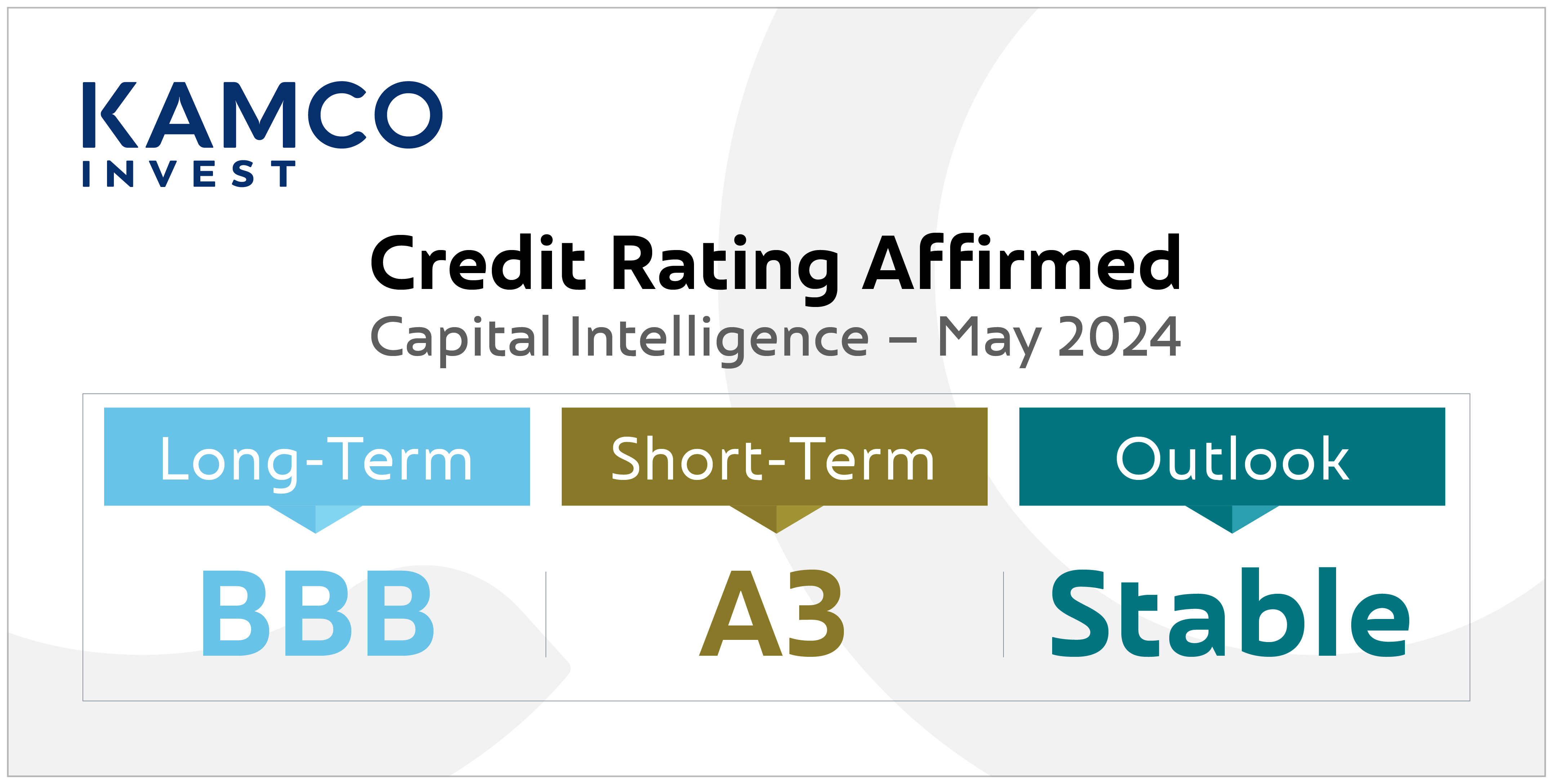

Faisal Mansour Sarkhou, Chief Executive Officer, commented, “The investment grade rating from Capital Intelligence is a strong validation of Kamco Invest's financial stability, solid business model, and management capabilities. We remain persistent in our commitment to fulfilling our responsibilities to stakeholders, actively creating value, and providing innovative investment solutions to our clients.”

Kamco Invest has assets under management of USD15.6bn, making it the 7th largest asset manager in the MENA region according to the latest report issued by Forbes Middle East. The Company enjoys a strong financial position and healthy capital structure with KWD61.5mn in shareholders’ equity as of 31 March 2024.

Furthermore, the company reported growth in various aspects during the first quarter of 2024 where total revenue rose by 155.2% to reach KWD6.7mn (Q1 2023: KWD2.6mn), and revenues from fees and commissions increased by 7.4% to reach KWD3.5mn (Q1 2023: KWD3.3mn). What is more important is the quality of revenues where more than 52% of its revenue is generated from fees and commission.

Sarkhou concluded, “We are focused on expanding our team and enriching their skills and expertise, particularly in key markets such as Saudi Arabia and the Dubai International Financial Centre (DIFC). This strategic expansion aims to not only enhance our fees and commission income but also expand our client base and strengthen our presence and competitiveness in these vital markets.”